From our wide range of methods and techniques, we select the optimal mix for our clients’ information needs.

The result is relevant market information which ensures better decisions.

QUALITATIVE

QUANTITATIVE

Individual interviews / in-depth interviews

In-home, in-store or in-company interviews

Friendship-pair interviews

Expert interviews

Observation

Netnography

Traditional focus groups

Online focus groups

Mystery Shopping

Multi-Sensory Sculpting®

Associative / Projective Techniques

Experience Mapping

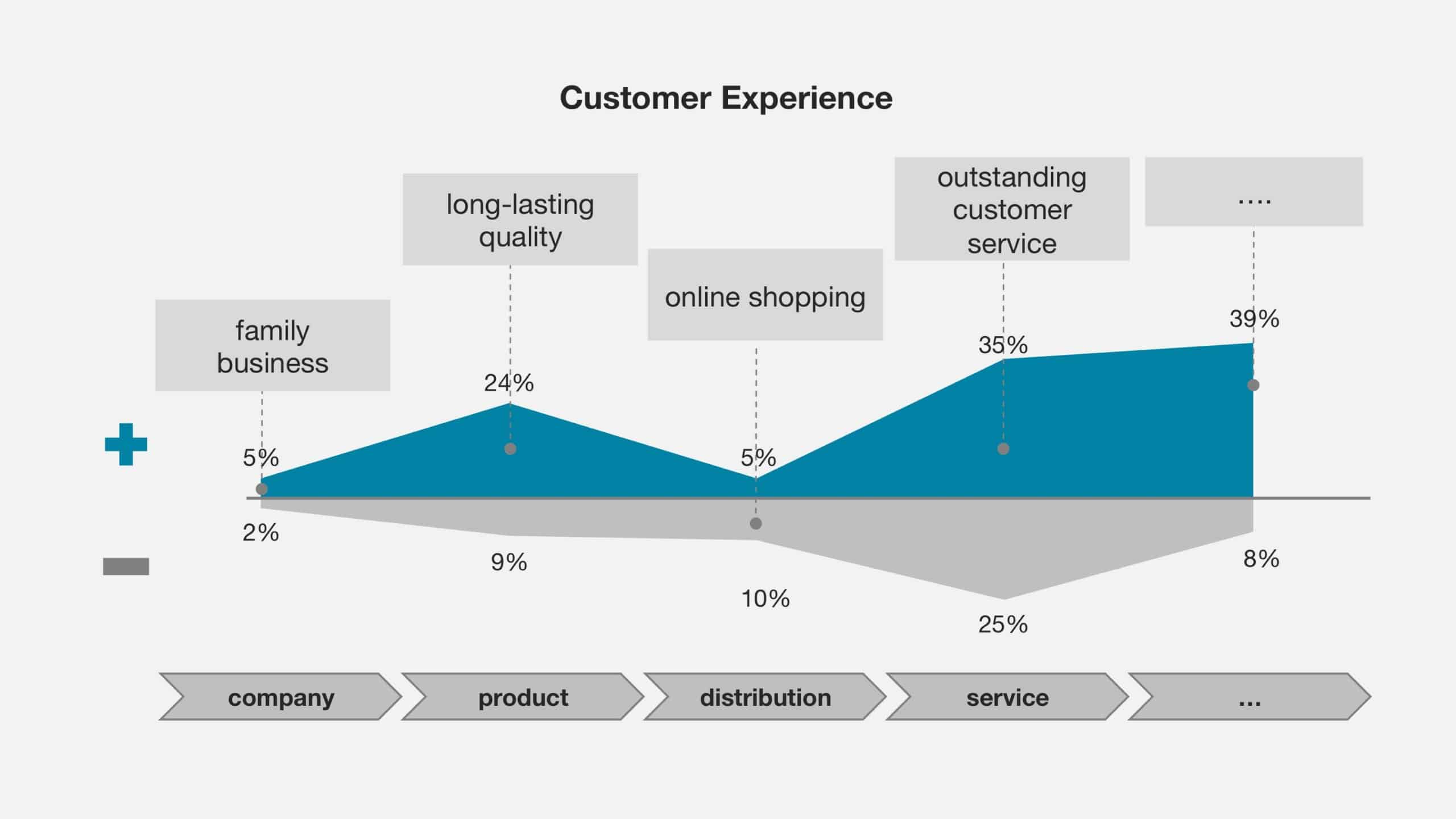

Customer Journey

Diaries

Means-End-Chain Analyses

Brand Association Maps

Collages

Storytelling

Image worlds

Prototype testing

Scenario analyses

Morphological box

Free Associations

Critical Incident Technique

Conjoint Analyses

Gabor Granger

Van Westendorf Price Sensitivity Meter

Causal/Driver Analyses

Time Series Analyses

Cluster/Factor Analyses

fsQCA

Correlation Analyses

Regression Analyses

Dynamic Analyses

Trend reports

Telephone surveys (CATI)

Online surveys (CAWI)

Paper & Pencil surveys

Experiments

Analysis of scanner data

QUALITATIVE

Individual interviews / in-depth interviews

In-home, in-store, or in-company interviews

Friendship-pair interviews

Expert interviews

Observation

Netnography

Traditional focus groups

Online focus groups

Mystery Shopping

Multi-Sensory Sculpting®

Associative / Projective techniques

Experience mapping

Customer Journey

Pre-Tasks

Diaries

Means-End-Chain Analyses

Brand Association Maps

Collages

Storytelling

Image worlds

Prototype testing

Scenario analyses

Morphological box

QUANTITATIVE

Trend reports

Telephone surveys (CATI)

Online surveys (CAWI)

Paper & pencil surveys

Experiments

Analysis of scanner data

Free associations

Critical incident technique

Conjoint analyses

Gabor Granger

Van Westendorf Price Sensitivity Meter

Causal/driver analyses

Time series analyses

Cluster/factor analyses

fsQCA

Correlation analyses

Regression analyses

Dynamic analyses