CUSTOMER SATISFACTION AS A FACTOR FOR SUCCESS

Higher customer satisfaction requires market research insights

Information regarding customers’ satisfaction with product and service experiences is a prerequisite for continuous improvement and innovation – with the ambition of excellence.

Top questions

- Which elements of the service process/product features drive customer enthusiasm/dissatisfaction?

- Which changes to these product features/service elements are absolutely necessary?

- What is the minimum performance level to avoid customer dissatisfaction?

- At which level of performance do further improvements become inefficient to achieve higher customer satisfaction?

Customized satisfaction research

We specifically design surveys for your business and use the best combinations of scientifically sound methods. We have vast experience even in complex B2B settings.

Implications for action and support in implementation

We accompany our clients throughout the entire process, from defining the scope of research, setting objectives and the implementation of improvements. You receive action-oriented information and recommendations to implement customer-centric processes and contact points. Our strategy consultants accompany this process and help to establish customer orientation in your company.

Continuous improvement with ongoing customer satisfaction monitoring

Monitoring of the most relevant satisfaction and touchpoint KPIs (such as the Net Promotor Score (NPS), performance ratings, complaint frequency and content, as well as positive and negative experiences) help to continuously improve processes in a customer-centric way.

We help you to create an efficient customer satisfaction monitoring system using both internal and external data sources.

Exemplary outputs from customer satisfaction studies

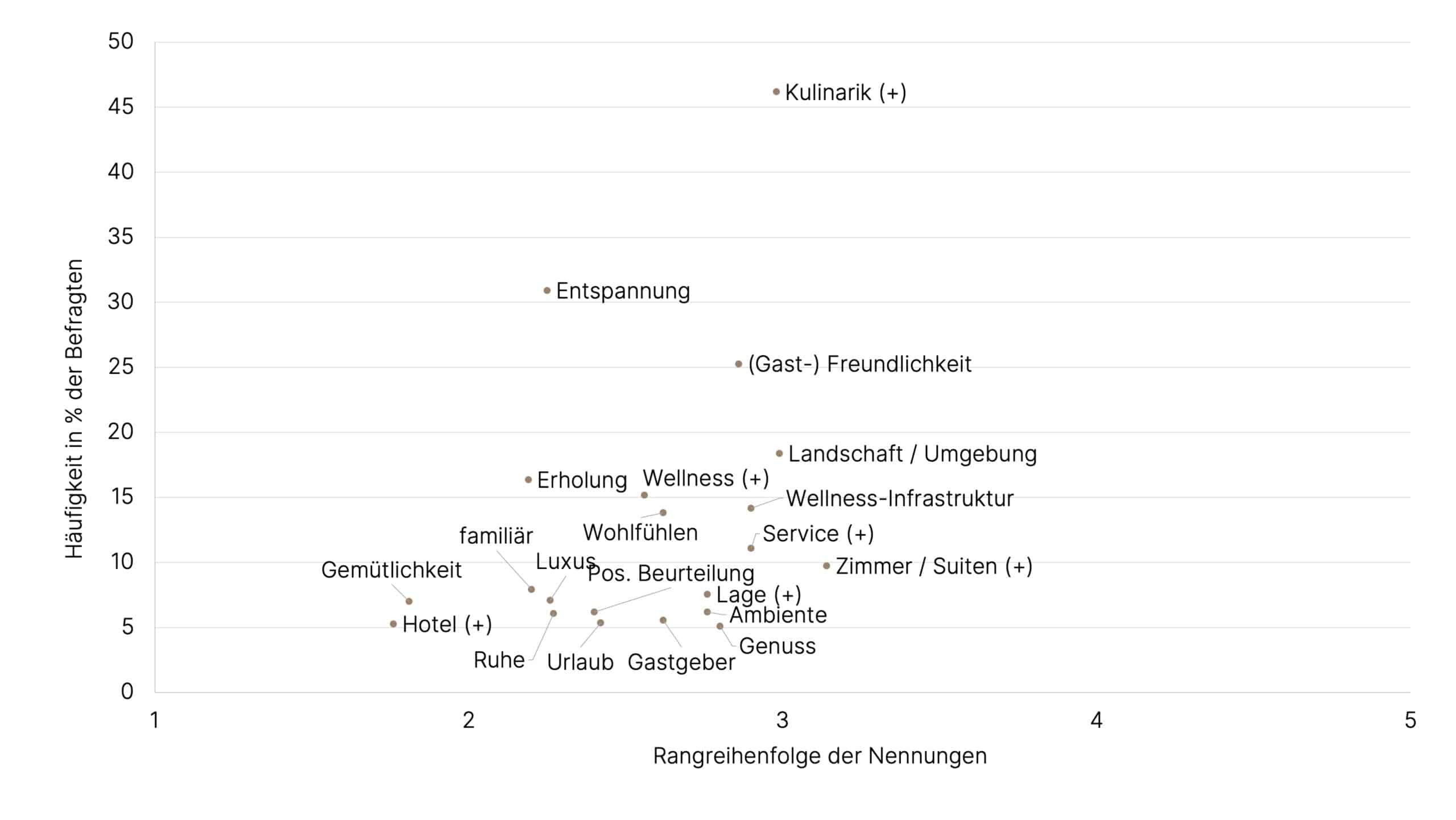

Associations

Net Promotor Score (NPS)

Driver Analysis

Rating scales

Adventures

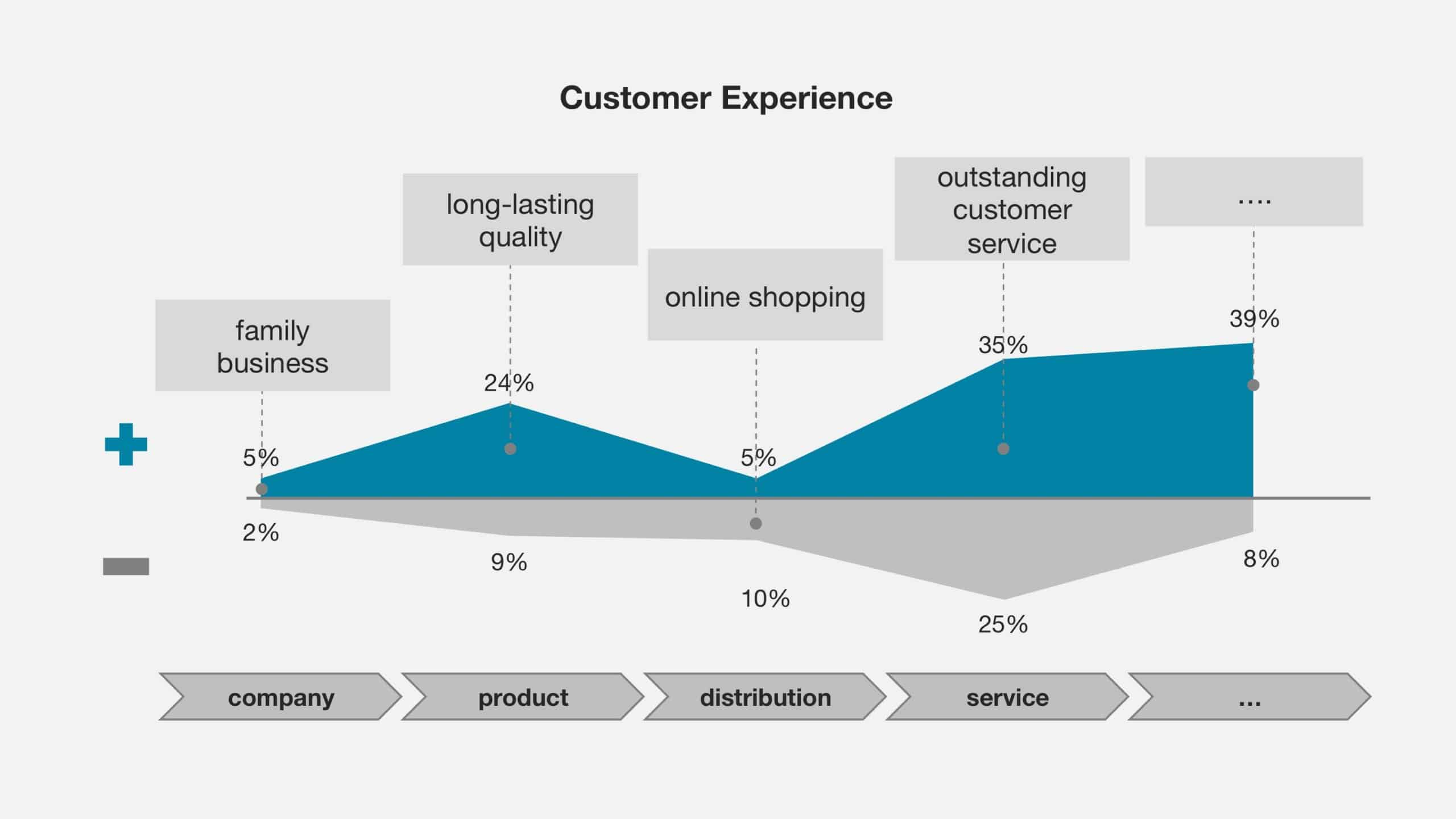

Contact point analysis

Levers for improvement

Toolbox

AI supported text analysis

Analysis of scanner data

Associative/Projective Techniques

Observation

Image worlds

Brand Association Maps

Cluster/factor analyses

Collages

Conjoint analyses

Critical Incident Technique

Customer journey

Diaries

Dynamic Analysis

Individual interviews/in-depth interviews

Experience mapping

Expert interviews

Free Associations

Friendship Pair Interviews

fsQCA

In-home, in-store or in-company interviews

Causal/driver analyses

Max Diff

Means-end chain analysis

Morphological box

Multi Sensory Sculpting®

Mystery shopping

Net Promoter Score (NPS)

Netnography

Online focus groups

Online surveys (CAWI)

Paper & Pencil surveys

Regression analyses

Storytelling

Scenario Analysis

Telephone surveys (CATI)

Traditional focus groups

Trend reports

Time series analyses

Context analysis